Insights

By: Gerrit Smit

When will Growth make a comeback?

The much reported ‘great rotation’ towards Value investing this year has seen investors drastically reduce their positions in Growth stocks – those companies expected to grow sales and earnings at a faster rate than the market average. As manager of a Growth fund, Gerrit Smit has “felt the same pain”. Nevertheless, he believes there are some early signs that Value’s most recent good relative run may not continue for long.

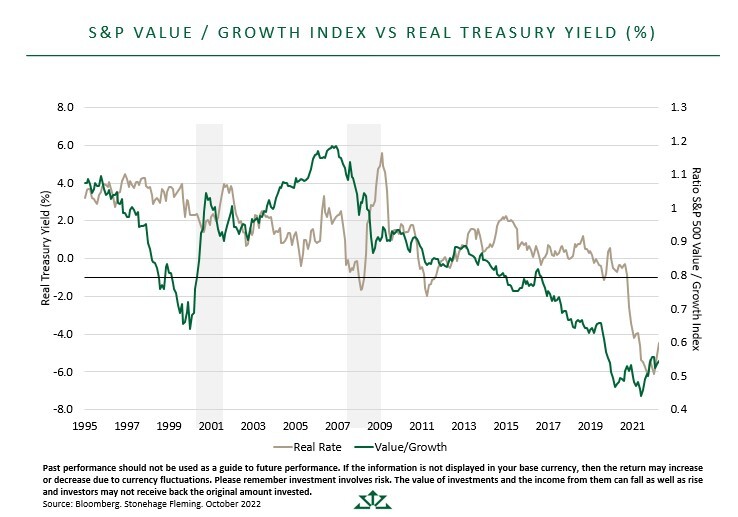

“The correlation between the relative Value/Growth index and the real treasury yield (see Chart 1) clearly demonstrates Value’s ‘need’ for positive real rates”, he told guests at a Now and for future generations webinar, hosted by Stonehage Fleming last Thursday.

Chart 1

“In the period between 2001 and 2007, real rates were positive and Value had a relatively longer period of outperformance,” noted Gerrit, who manages a concentrated, high conviction portfolio of a maximum of 30 best in class holdings in the Stonehage Fleming Global Best Ideas Equity Fund. “Currently, however, real rates are in deeply negative territory. As inflation drops, that may change but it is likely to take quite a while before it goes back into high positive levels. That’s a situation which, I would argue, rather favours the Growth style of investing.”

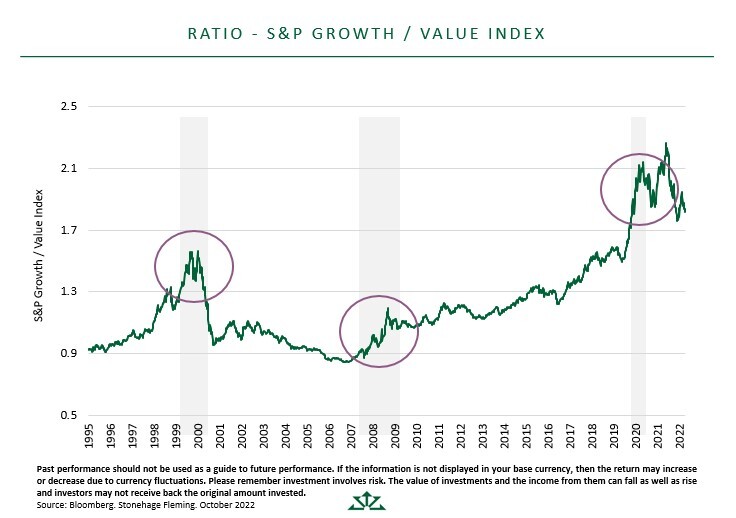

Furthermore, Gerrit argued, the continuing period of economic weakness may also prove to be a relatively more positive environment for Growth than for Value stocks (see Chart 2). “During times of low economic growth or even a recession, growth becomes more difficult to achieve on a sustainable basis. The result is that companies that continue to grow during a downturn outperform Value as investors are then more willing to pay more for it on a relative basis.”

Chart 2

A look at the three previous US recessions bears out this theory. “In all the three most recent recessions, Growth stocks have outperformed by about 20%. Should that happen again (and odds for a recession are growing) Growth managers may catch up materially, and their shorter-term track records be restored.”

Read more on the Economic Outlook

Disclaimer: This article has been prepared for information only. The opinions and views expressed on any third party are for information purposes only, and are subject to change without notice. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes.

All investments risk the loss of capital. The value of investments may go down as well as up and, you may not receive back the full value of your initial investment. Changes in the rates of exchange between currencies may cause the value of investments to go up or down. We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194). This document has been approved for distribution in the UK, Switzerland and South Africa. Approved for distribution in Jersey by affiliates of Stonehage Fleming Investment Management that are regulated for the provision of financial services by the JFSC.

© Copyright Stonehage Fleming 2022. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.