Stonehage Fleming is adviser to many of the world’s leading families and wealth creators. We manage and protect their wealth, often across several geographies and generations.

We have been privileged to support our clients including the Fleming Family over several decades, in the process bringing together talented professionals to offer a range of skills and capabilities rarely found in one firm. Acting as a full service Family Office, or working in conjunction with other trusted advisers, we are able to draw on over 40 years of practical experience helping discerning clients address the challenges of creating and preserving wealth.

Our clients have entrusted us with the management, fiduciary oversight and administration of in excess of US$175bn. We offer our services from 20 offices in 14 geographies.

Independently owned by management, staff and a publicly quoted family investment trust with a patient capital philosophy, our goals are precisely aligned with those of the clients we serve.

Our values

We embrace the values that make a family harmonious and successful, acting with integrity and striving for excellence in everything we do.

Family

Embracing the behaviours that make families harmonious and successful, we listen to each other and act with common purpose to benefit our clients, our partners and colleagues.

Moral courage

Acting with integrity and conviction, we are never afraid to ask difficult questions and seek to do the right thing without exception.

Excellence

We pride ourselves on consistently delivering excellent work and building relationships of the highest quality. For us excellence is more than an aspiration.

Our social capital

Our Social Capital is the means by which we engage with and demonstrate our commitment to society and the communities in which we work and operate. We are dedicated to driving positive change and sustainable growth through our business and our partners.

Demonstrating our

social capital

View More

The principles that underpin our approach

Principle one

Challenge convention

We have deep roots and traditional values, but we continuously adapt to changing needs. Most wealth managers focus primarily on liquid assets, but we seek to add value across the entirety of the family’s wealth. We understand that the entrepreneur’s view of risk often conflicts with that of professional investment managers. We seek to bridge the gap. We believe the provision of an integrated service requires a different sort of organisation, based on teamwork rather than individual targets.

Principle two

Harness the power of listening

Many businesses are much better at telling you what they offer than understanding what you want. That is why we regard listening and asking insightful questions as a fundamental skill - key to understanding not just what our clients want, but also what they need. Thoughtful listening and well informed questions have helped us become authentic, trusted advisers.

Principle three

Make excellence a prerequisite

Nothing less than excellence is acceptable in all areas of our service. To us, excellence is more than being the best at what we do, it means ensuring our client always receive what is best for them. Whether we are utilising in–house expertise or working with outside specialists, we will always choose what is right for the client.

Principle four

Go beyond technical knowledge

We pride ourselves on the exceptional breadth and depth of our technical knowledge. But at Stonehage Fleming we also offer something even more valuable: practical wisdom. We have acquired this wisdom from the experience of working with international families for over four decades. It is extraordinary how often we draw on the lessons learnt from other families to expedite practical solutions.

Principle five

Act with moral courage

Integrity requires the courage to do the right thing, whatever the pressures may be. One reason we enjoy the trust of our clients is because moral courage is a part of our culture. Our staff are encouraged to speak out, even when they are a lone voice in the crowd. As an outsider on the inside, we can offer impartial opinion that really is in the best interests of the family.

Principle six

Act as one

Our staff are accomplished at thinking from the perspective of the client, rather than seeing things through the prism of their own expertise. We only hire those who excel in a team environment, focused on the client’s interests. Our ‘one-firm-firm’ culture helps all our areas of expertise work together seamlessly, responding to our clients’ needs.

Principle seven

Lead quietly

We are committed to being leaders in our field, but we go about our business quietly and efficiently, because discretion is all important. The best and most durable decisions are generally made by clients and client families themselves, with advisers who support, inform and facilitate the process, rather than trying to impose their own views, solutions or products.

Principle eight

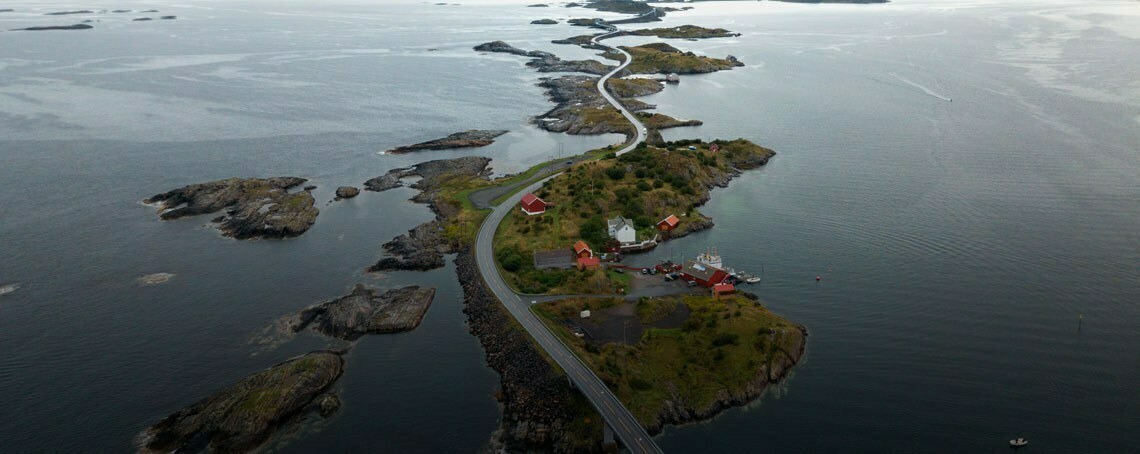

Transcend borders

Many of our clients are global citizens and all our clients value the international perspective we offer, with access to contacts and investment opportunities world-wide. We are an international business, with a presence in 14 jurisdictions around the world. Our culture and approach are shaped by the combination of deep roots in local communities with a modern international outlook.