Insights

By: Alastair Dean

US viewpoint: Four key investment themes to watch – Alastair Dean

Which sectors are most likely to benefit under President Trump?

With President Trump taking the stage, the US election outcome has undoubtedly introduced a degree of uncertainty into the world. The outlook for many long-term investment themes, however, remains robust.

The drivers of technological innovation and dynamism of the global economic system continue to provide a solid investment backdrop. Meanwhile, the US system of democratic checks and balances should mitigate the impact of any single administration.

Though campaign promises do not always translate into actions, and the interplay between legislative, executive, and judicial operations makes concrete predictions difficult, Republican control of the House and Senate means that President Trump will have greater power to implement his agenda. There are several long-term investment themes that are likely to thrive as a result.

Manufacturing and National Security

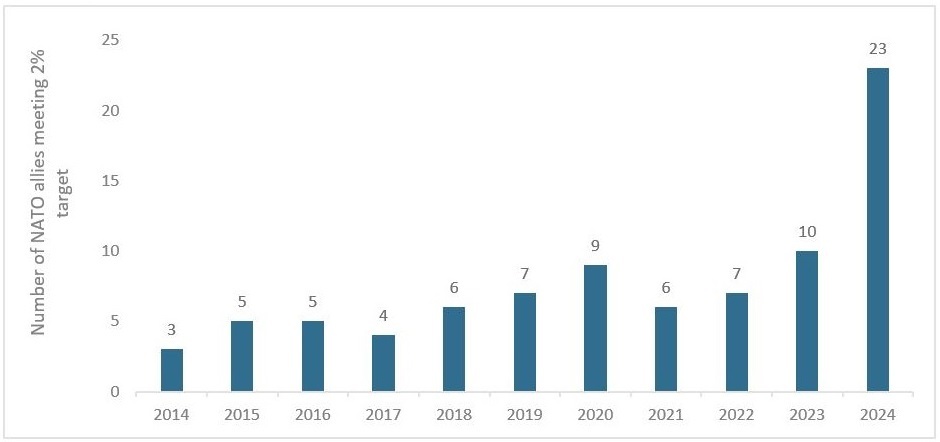

Manufacturing and national security programmes are expected to see significant policy support through reshoring initiatives and increased defence spending. Trump has also emphasised the importance of other NATO countries contributing to their defence spending. The Trump administration may offer substantial tax incentives and impose high tariffs, potentially up to 60% on Chinese imports, to encourage domestic production and bolster the security sector. These policies align with Trump's ‘America First’ agenda and protectionist trade policies.

23 NATO Allies now expected to meet or exceed 2% target of GDP spend on defense

*Source. NATO. Data as at 12 June 2024, based on 2015 prices and exchanges rates. Figures for 2023 and 2024 are estimates.

Energy

Trump's policies are expected to favour traditional energy sectors like fossil fuels and nuclear power, potentially at the expense of renewable energy. In a recent announcement of a new National Energy Council, the President-elect emphasised “dramatically increasing baseload power” for the electric grid. This initiative should aid in clearing hurdles around new natural gas power development, and embrace further nuclear expansion.

Federal support could potentially shift towards small modular reactor (‘SMR’) deployment which could receive greater backing as a more efficient alternative to large nuclear projects. Notably, the incoming Energy Secretary, Chris Wright, who sits on the board of SMR development company, Oklo, has historically advocated for a material increase in US nuclear energy production. Additionally, grid infrastructure modernisation could present selective opportunities for technologically advanced companies.

Technology

Technological innovation, particularly in AI and semiconductors, stands to benefit from a deregulatory agenda. The potential rollback of President Biden’s AI safety mandates could create a more business-friendly landscape for both emerging start-ups and established tech companies.

Meanwhile, the easing of anti-trust scrutiny would also be advantageous. Semiconductor manufacturers might see increased domestic production incentives, driven by goals to reduce reliance on foreign manufacturers. Although there could be some short-term disruption depending on the implementation of tariffs, which are currently targeted at China, areas like cybersecurity are poised to benefit from AI advancements and a focus on national security.

Finance

The financial sector is expected to gain from potential deregulation, corporate tax cuts, and a business-friendly regulatory approach. Insurance companies, in particular, should benefit from this pro-business outlook. However, some areas remain uncertain, such as the inflation outlook and longer-term climate implications of Trump’s policies which are key factors for insurers. We also expect the cryptocurrency and digital assets ecosystem to experience increased institutional adoption and regulatory flexibility, although the assets themselves are likely to remain volatile.

While a Trump presidency may expose some losers among the megatrends shaping the thematic investment landscape, many businesses will be able to take advantage of the opportunities presented by anticipated policy shifts. The pro-business stance and moves to deregulate, in particular, are likely to foster growth in select long-term investment themes.

Alastair Dean is a Director focusing on equity research and manager selection at Stonehage Fleming Investment Management. He is responsible for due diligence and research on global and regional equity mandates, and is also a member of both the Sustainable and Thematic Investment Committees.

Find out more about Stonehage Fleming's Investment Management offering

Read more about thematic investing

Disclaimer: This communication has been prepared for information only and is not intended for onward distribution. It is neither an offer to sell, nor a solicitation to buy, any investments or services. Opinions expressed here are as of the date of publication and subject to change without notice. Stonehage Fleming Investment Management Ltd shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).

© Stonehage Fleming Investment Management Limited 2025