Insights

By: Graham Wainer

US election viewpoint - Does the stock market care who's in charge?

Apart from the inevitable short-term volatility, the election of Donald Trump as the new President of the USA sees investment markets breathing a huge sigh of relief. For one thing, it ends any speculation there may have been around civil unrest or the requirement for any Supreme Court decisions.

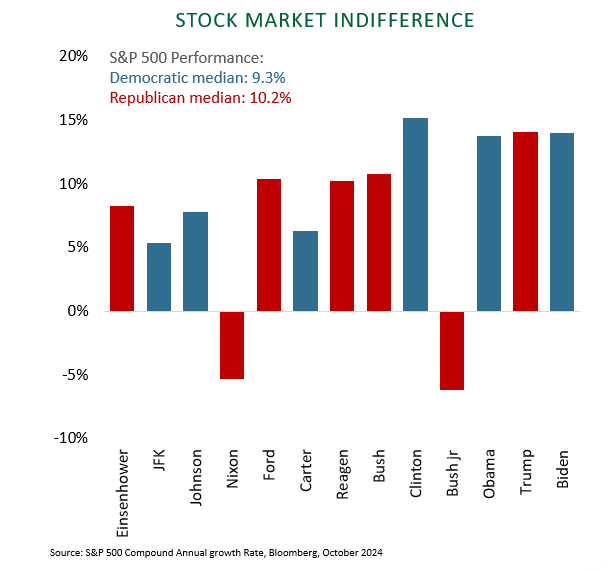

Arguably, there will be industry-specific winners and losers, including Oil and Gas (winners) and electric vehicles (losers). But, weirdly enough, despite all of the short-term noise, the historical evidence suggests that the stock market is largely indifferent to who's running the country.

If you look back in history, apart from prolonged, economically devastating events like the Vietnam War, you can hardly see daylight between the Democratic and Republican eras for returns (see chart). During the fall out from 9/11, for instance, the stock market actually performed well.

Is the US market bigger than the presidency?

The first reason for this is the large size of the market. Together, the NASDAQ and the New York Stock Exchange boast a market cap of over almost $60 trillion[i]. Though federal legislation is hugely important, people tend to forget the impact of state legislation and what happens in, for example, Florida or California can often be more important than who is resident at Capitol Hill.

What effect will President Trump’s posturing have?

When it comes to a Trump presidency, it is hard to predict. Things may be different this time but there are things we do know. First, he holds traditionalist, mercantilist views about how the economy works: maximise exports and minimise imports. He is also likely to be much more cautious on the budget and encounter push-back from the more conservative elements of the Republican party who are notably anxious about the size of US debt. Trump has said that he wants to cut taxes. He has also stated his intention to run a much bigger deficit, which will undermine the dollar, be bad for interest rates, negative for inflation and increase the cost of living. It will all come to a head eventually if he plays fast and loose with his spending plans. All of which will have an effect on the bond market, which is already ticking up in anticipation.

Furthermore, the issues around the proposed imposition of tariffs are very likely to be problematic. He has talked about 20% Universal Tariff, 60% on the Chinese and 100% on Mexican car production. While initially this may result in tax receipts, it could be extremely damaging for trade if we have reciprocal actions from US trading partners, resulting in a trade war.

Ultimately, though, a large portion of what Trump has talked about recently may turn out to be hype. To a certain extent, he can simply be seen to be establishing his negotiating position. Broadly, the markets know this, and will likely to carry on, largely unbothered by who's in charge.

[i] Source: Statista, September 2024

Graham Wainer is CEO Investment Management, with overall responsibility for Stonehage Fleming’s investment management business. He is also Chairman of the Investment Committee.

This is an extract from his presentation to guests at the 2024 Stonehage Fleming Family Investment Conference, held in London on the day of the US election results.

Read more from Graham

Quarterly investment outlook (Q3 2024)

Two minutes with Graham Wainer

Disclaimer: This communication has been prepared for information only and is not intended for onward distribution. It is neither an offer to sell, nor a solicitation to buy, any investments or services. Opinions expressed here are as of the date of publication and subject to change without notice. Stonehage Fleming Investment Management Ltd shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).

© Stonehage Fleming Investment Management Limited 2024