Insights

By: Peter McLean

US election poses uncertainty for investors as Trump’s dominance grows

Domestic polarisation and geopolitical instability combine to unsettle the outlook

Elections often spell uncertainty for markets, but the combination of global instability and domestic polarisation, deepening political and social divisions, makes this year’s US Presidential election particularly uncertain for investors.

Much will depend on the state of the US economy in the second half of the year. If a recession is avoided and consumers feel the benefit of rising real incomes, the re-election of President Biden will become more likely as voters are reassured that things appear to be ‘going well’.

US resilience in 2023 can be largely attributed to robust consumer spending which steered the economy through challenges such as a regional banking crisis and the sharpest rise in interest rates since the 1970s. Savings accumulated during the pandemic and a strong labour market further contributed to this resilience.

Having rejected the consensus expectation for recession in 2023, we expect the US economy to moderate in 2024, with growth slowing from the current six month run-rate of 3.5% per annum (Source: Bloomberg, September 2023).

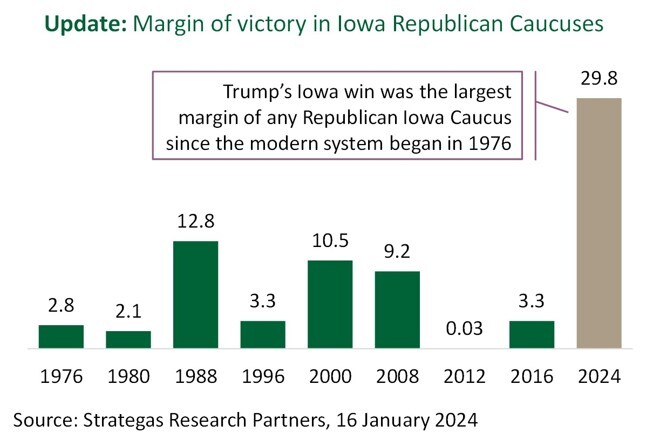

However, a more meaningful economic deterioration by November cannot be ruled out. Such a scenario would dent confidence in the current president and embolden the Republican nominee, who currently looks likely to be former President Trump, see chart.

Whatever the outcome, the implications of this contest are substantial. Geopolitical tensions will remain high given questions over US foreign policymaking for 2025-2029, with NATO membership at stake.

Furthermore, with an incentive to undermine the likelihood of President Biden’s re-election, Russia may attempt to apply pressure through the energy market or by escalating the Russian offensive in Ukraine. Elsewhere, the risk of miscalculation in the Middle East and with China is also high, with the opportunity to exploit domestic polarisation in the US.

With a backdrop of uncomfortably high risk around geopolitical escalation, an investment strategy which embeds multiple diversifying assets and adopts a flexible approach is more vital than ever.

Disclaimer: This article has been prepared for information only. The opinions and views expressed on any third party are for information purposes only, and are subject to change without notice. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision.

All investments risk the loss of capital.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).

© Copyright Stonehage Fleming 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.