Insights

Understanding Cyclical Stocks

Ongoing vaccination efforts and economic re-opening have seen the global economy well-positioned for a substantial pickup in growth for the remainder of 2021 and the year ahead. This resurgence in economic prospects has seen the share prices of cyclical stocks improve materially since the lows of 2020.

Being sensitive to fluctuations in the business cycle, cyclical companies tend to outperform during periods of economic expansion and underperform during periods of economic contraction.

Cyclical Sectors

Cyclical businesses are commonly found in sectors such as energy, mining, construction, autos, airlines and hotels and leisure. For example, airlines and companies in the hotel and leisure sector benefit materially as spending on holidays increases during periods of prosperity. These same businesses are usually hit hard during periods of economic contraction, as holidaymakers switch to ‘staycations’ or delay travel plans in response to declining disposable incomes.

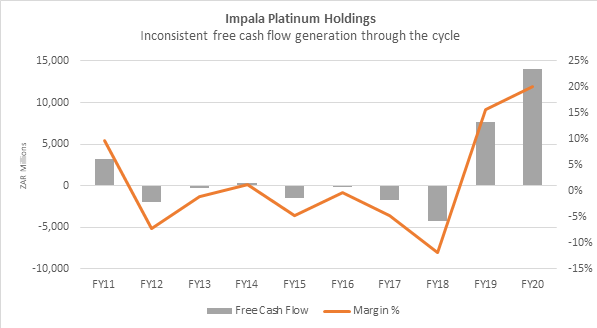

These businesses typically lack pricing power and have limited sources of recurring revenue, making it particularly difficult to sustain financial performance during a downturn in economic activity. As such, it is rare to find a cyclical company capable of delivering consistent, positive free cash flows through the cycle. This is especially true for cyclicals in capital intensive sectors such as energy and mining. Figure 1 illustrates the free cash flow generated at Impala Platinum Holdings over the ten years to June 2020.

Figure 1. Source: Factset, Stonehage Fleming, May 2021. Note Impala Platinum Holdings results are shown for the financial years ended June. Margin shown as free cash flow as a percentage of revenue.

Forewarned is forearmed

Investing in cyclicals is about timing. Investors should also understand that the stock market discounts what it expects to happen, not what is happening now.

Successful investments in cyclicals typically occur at (or around) the point of maximum pessimism, when signs of an improvement in the underlying economic cycle are emergent but not yet reflected in share prices. Similarly, the successful sale of a cyclical stock tends to occur at (or around) the point of maximum optimism or euphoria.

While there appears to be an opportunity in cyclical companies, the reality is that much of the good news may already be priced into those shares.

A common pitfall of investing in highly cyclical businesses is the failure to fully appreciate the impact of cyclicality in the business on fundamentals like sales growth, cash flow generation, balance sheet strength and returns on capital.

This can lead investors to simply extrapolate current trends into the future. Given that cyclical dynamics can change rapidly, material errors of over- or under-valuation can arise that ultimately drive a misallocation of capital and poor returns to the investor.

Long-term Compounders

In our view, successful investing is not about identifying and timing cyclical factors. Rather, it is about strategically identifying businesses with healthy fundamental attributes that are exposed to sustainable long-term trends. In other words, businesses that are able to compound shareholder value through-the-cycle.

Such companies typically exhibit an enviable combination of a number of the following attributes: competent management with appropriately aligned incentives; pricing power; a high proportion of recurring revenue with sustainable growth prospects; superior operating efficiency and cash flow generating ability; limited financial leverage and finally; high and relatively stable returns on capital. Unlike cyclicals, businesses with these attributes tend to be largely unaffected by the constant ebb and flow of the business cycle.

As mentioned above, investing in cyclicals is inherently about timing the market. In order to be successful, investors need to be able to consistently call the peaks and troughs of the market which is notoriously challenging even for the greatest of investors.

Find out more about Stonehage Fleming's Investment Management offering

Disclaimer: This document has been prepared for information purposes only and does not constitute a personal recommendation or advice or a solicitation to buy any product or service. It does not take into account the financial circumstances, needs or objectives of the recipient. In addition to the information provided, you may wish to consult an independent professional adviser. Past performance is not a guide to future performance. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. The distribution or possession of this document in certain jurisdictions may be restricted by law or other regulatory requirements. Approved for issue in South Africa by Stonehage Fleming Investment Management (South Africa) (Pty) Ltd (FSP No. 42847). © Stonehage Fleming 2021.