Insights

By: Peter McLean

No real evidence of a systemic banking crisis in the US – Peter McLean

Over the last 18 months or so, the Federal Reserve has embarked on its fastest hiking cycle in over 40 years in its efforts to curb inflation. Money market yields have followed, with the 3-month Treasury Bill now yielding approximately 5% per annum (Source: Bloomberg, May 2023). Unfortunately, the banking sector has not raised savings rates to the same extent, which has caused a number of depositors to remove their capital and invest in money market funds in search of better cash returns.

Although the press has made much of this trend in recent weeks, with First Republic the latest US regional bank to fail, a full blown banking crisis remains unlikely.

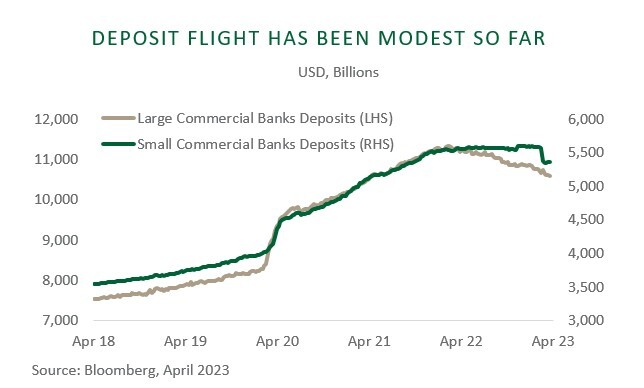

Chart 1

A look at the broader picture of deposits in the US banking system over time (Chart 1) shows deposits jumping, then increasing during the pandemic as people were confined to their homes for extended periods of time. Total deposits at domestic commercial banks rose by more than 35% since the end of 2019 and stood at around $18 trillion as of the fourth quarter of 2021 (Source: US Federal Reserve).Then, over the course of the last 12 months or so, they can be seen to decline as depositors have rotated into money market funds. What can also be seen, is that the extent of the level of deposit flight is not substantial.

Extreme cases of banks in crisis, like the collapse of SVB Financial Group or First Republic, will always capture the attention of headline writers. Currently, however, there is no real evidence of a systemic crisis. Those outflows that are happening are doing so at more of a trickle than a serious exodus.

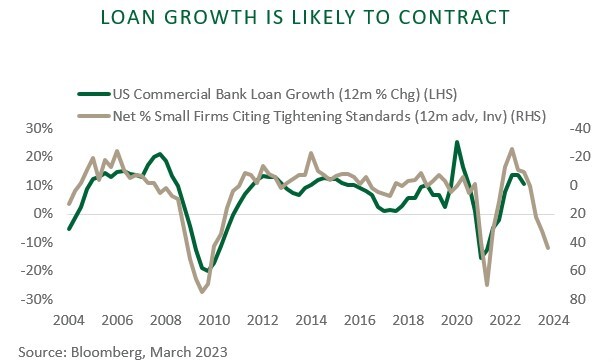

The more meaningful fallout for the wider market is that banks are going to be operating more cautiously with this sort of dynamic in play. Small companies are seeing tighter credit conditions (Chart 2). What will follow is loan growth within the banking sector falling too.

Chart 2

While saying a full blown banking crisis is on the cards is over doing it, there are new headwinds to growth for small businesses in particular. Any hiring and investment plans are likely to be pared back and the availability of loans has come down quite sharply in the last six months or so.

Read more on the Economic Outlook

Disclaimer: This article has been prepared for information only. The opinions and views expressed on any third party are for information purposes only, and are subject to change without notice. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision.

All investments risk the loss of capital.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).

© Copyright Stonehage Fleming 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.