Insights

By: Peter McLean

Investment Viewpoint - Peter McLean

US Growth and Inflation: Focus on the Fundamentals

The US economy is diverging from the anticipated Trump 2.0 narrative. Contrary to expectations of a 'golden age' of US exceptionalism, recent evidence has not been so convincing. Consumer confidence has declined for the third consecutive month, the labour market is cooling, and the housing sector remains stagnant due to persistently high interest rates. Policy uncertainty is widespread, with the looming threat of tariffs driving up inflation expectations.

Looking through the noise

In October 2024, we noted that “the evidence suggests a ‘growth acceleration’ scenario is relatively unlikely in the next year.” Despite the election win of President Trump raising expectations for future growth, the economic softening we are currently witnessing has been building for several months. As we highlighted in our 2025 Investment Outlook, “the possibility of a 2025 growth scare appears to be widely underestimated.”

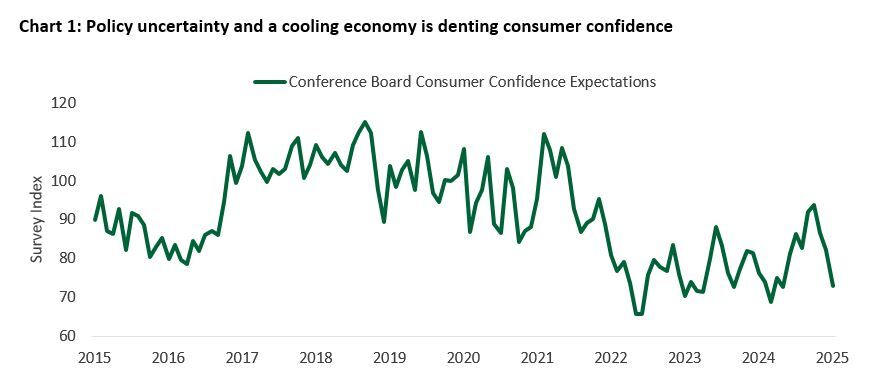

The reason for our note of caution in recent months is that the insulation that surrounds the US consumer has worn thin. In contrast to 2022-23, when our outlook was notably more constructive than most, real incomes are now falling and pandemic-era savings have been spent. Job vacancies are much lower than before, making it harder for those out of work to find new employment and those in work to negotiate higher wages. Furthermore, interest rates have been elevated for about two years now, weighing on housing activity and loan demand. Consumers are clearly concerned (chart 1[1]), despite the initial hope that President Trump would usher in a period of reinvigorated US growth.

Importantly, the moderation we observe follows a prolonged period of above-trend growth. Annualised real GDP growth is currently tracking at 2.3% for the first quarter[1], having grown by 2.5% per annum in the fourth quarter of 2024. This remains far from recessionary territory, and is sufficient to support earnings growth and equity returns over time. Yet, what matters is how this compares to the weight of expectations. Sentiment towards the US started the year at very high levels, driven by the hope of Trump 2.0 exceptionalism. As the observable pattern of economic rebalancing towards a more moderate rate of growth has continued, investors nerves have been shaken.

The disinflationary trend is largely intact

In addition to signs of softer growth, the trajectory for US inflation has also been a topic of focus in recent weeks. Since CPI peaked at 8.5% in June 2022, investors have been reasonably confident that inflationary pressures were subsiding. Yet the disinflationary narrative has come under heightened scrutiny since the second half of 2024 as inflation prints appeared ‘stickier’ than expected. The return of President Trump further stoked the flames of American growth optimism, and some measures of inflation expectations have increased.

Most recently, the January CPI reading rose to 3.0% year over year, up from 2.9% in December[1], surprising most analysts. Many economists cite the risk of higher inflation becoming embedded, particularly since President Trump's tariff agenda could lift import prices and drive up inflation expectations, itself a key driver of price pressures. Yet deeper analysis of the data tells us that the risk of a second inflation wave is far from the most likely outcome.

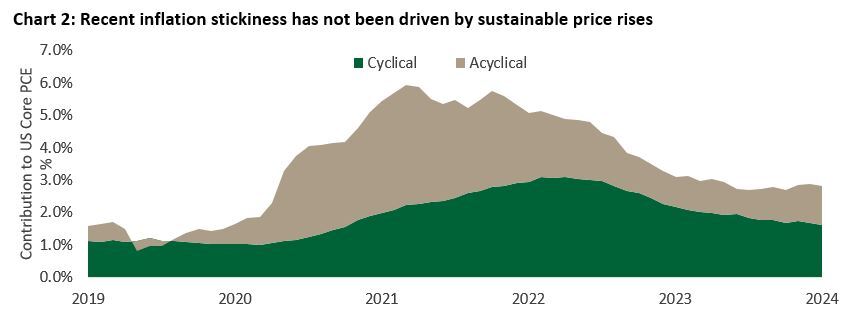

Critically, those items in the inflation calculation which drive sustained price rises, particularly those related to housing and consumer services, have continued to exhibit falling inflation. The San Francisco Federal Reserve has recently undertaken some useful analysis, splitting Core PCE inflation, the Fed’s favoured measure, into ‘cyclical’ and ‘acyclical’ buckets (chart 2[2]). The latter component reflects items that may experience a price adjustment once a year (particularly at the start of a year) such as healthcare and insurance premiums. Cyclical items are more sensitive to the economic cycle and drive long-term inflation trends, as described above.

In 2021-22, price rises were broad-based - both components rose, creating a strong inflationary surge. Today, it is only ‘acyclical’ items that have lifted overall inflation readings. Over time, it is reasonable to expect this pressure to dissipate. The risk is that the recent seasonal lift in inflation is followed by tariff-related price increases. In which case, inflation expectations may start to spike, feeding an inflationary spiral. Recent evidence suggests that despite ongoing threats, reciprocal, measured, and gradual tariffs are favoured as part of a wider negotiation. With policy uncertainties notably high, we keep incoming data under close watch.

[1] Source: Bloomberg, February 2025.

[2] Source: Atlanta Fed GDP Now, 28 February 2025.

[3] Source: Bloomberg, January 2025.

[4] Source: San Francisco Federal Reserve, January 2024.

Disclaimer: Stonehage Fleming Services This communication has been prepared for information only and is not intended for onward distribution.

Opinions expressed here are as of the date of publication and subject to change without notice. Stonehage Fleming Investment Management Ltd shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. All investments risk the loss of capital.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).