Insights

By: Peter McLean

Investment Viewpoint: Us Market Turbulence - Peter McLean

Us Market Turbulence: A Correction, Or Something Else?

US equities remain subject to heightened volatility, as investors digest signs of softer economic data and erratic trade policy. The S&P 500 index has fallen c. 9% in recent weeks, while the ‘magnificent 7’ technology stocks have retreated c. 19% from their peak in Decemberi. In this short update we provide our assessment of economic and geopolitical developments and implications for investment strategy.

Slower Growth, Tariffs And DeepSeek

Equity markets are reacting to three main developments in 2025. Firstly, US growth has moderated from its firm momentum in the second half of last year. Secondly, having assumed that President Trump’s second term priorities will align with his first term ‘growth populist’ agenda, investors are adjusting to an erratic tariff-focused approach.Thirdly, following two years of AI-driven enthusiasm, more is being asked of mega cap technology companies to sustain their elevated valuations.

US Growth Is Slowing, Not Crashing

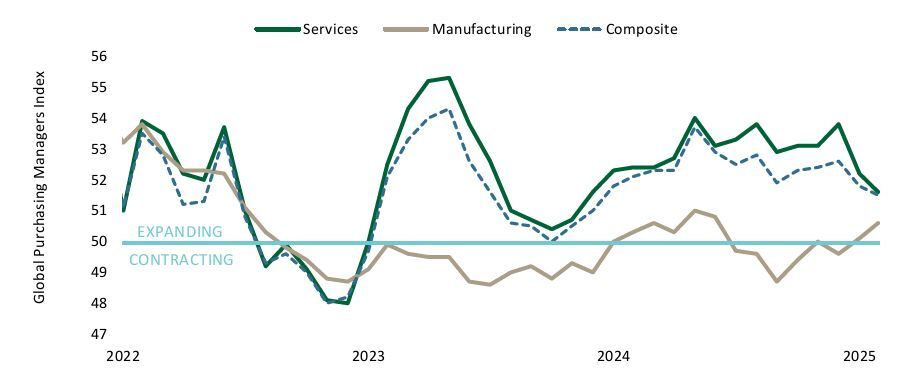

As highlighted in our 3rd March Investment Views update and the 2025 Investment Outlook earlier this year, there are signs that the US economy is transitioning to a slower growth rate (chart 1). This trend is consistent with broader patterns of reduced corporate hiring and wage gains, which have been emerging over the past 18 months.

Chart 1: Moderating US growth weighs on global services sector

As this slowdown has become more prevalent, concerns have grown that a US recession is imminent. Whilst recession risks have increased, the body of evidence does not support a significant decline playing out in economic activity. Companies often signal economic weakness before it becomes apparent to market participants. According to Factset, only 13 companies have mentioned recession risks in earnings calls since mid-December, the lowest number since early 2018iii. Corporate profit growth remains strong, real household spending growth is solid, and the manufacturing sector is showing improvement.

The source of market volatility is therefore shifting expectations. Investors who have been conditioned to expect unwavering US resilience in recent years are now adjusting to a phase of more modest growth. Additionally, President Trump's first six weeks in office have been tumultuous, introducing a significant source of uncertainty.

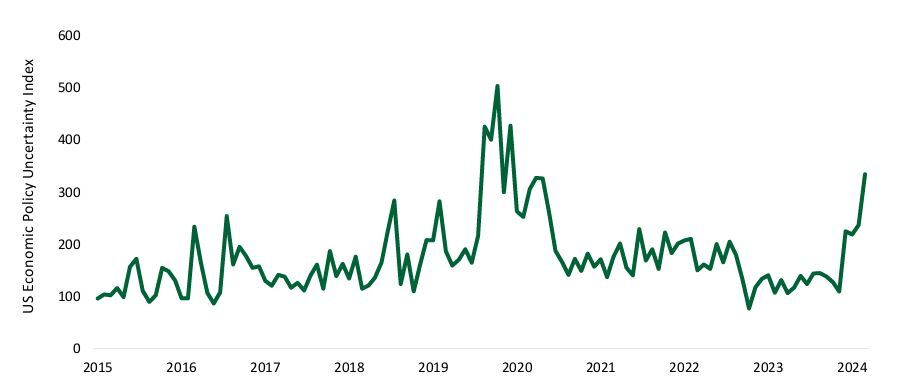

Tariffs: Uncertainty Matters Most

President Trump made his intentions to impose severe tariffs on key trading partners clear on the campaign trail, and has not wavered from this policy. Whilst this protectionist agenda was anticipated, its implementation has shaken confidence substantially (chart 2). With such a broad agenda to “fix everything about our countryiv”, the sequencing of Trump 2.0 policies is critical, and demonstrate a notable emphasis on tariff-led geopolitical reform in this early phase of his administration.

Chart 2: High uncertainty poses a headwind to US growth this year

Investors have therefore re-priced expectations to reflect higher tariffs sooner, without the growth-enhancing policies of lower taxes and deregulation. President Trump also appears more willing to tolerate economic pain in pursuit of these goals, highlighting how “there is a period of transition because what we’re doing is very bigvi” when asked about the possibility for recession.

Where tariff levels are concerned, there also remains a question of longevity. Already we have seen announced tariffs being delayed, subject to exemptions and negotiated down, suggesting that the current approach may ultimately prove to be a political tactic.

It is our view that the current focus on trade policy is part of broader political agenda to demonstrate strategic reform to the American electorate. However, this is not what matters the most. Even if tariffs are eased in the coming weeks or months with only modest implications for consumer prices, the negative growth impact of weaker confidence could take longer to repair.

Our approach therefore remains focused on the fundamentals, and we are watching closely for evidence that trade policy uncertainty is translating into broader consumer weakness or corporate stress.

AI and US Technology: Selectivity Matters

US mega cap technology has benefited from a strong AI driven tailwind over the past two years, propelling their earnings and market valuations higher. However, their momentum has reversed sharply, putting them at the epicentre of current equity market volatility.

Several factors are at play. While earnings and revenue releases for several AI-centric technology leaders exceeded expectations considerably for much of 2023-24, recent announcements show a lower growth trajectory, now reflected in reduced earnings estimates and valuations. Additionally, the assumption of strong competitive moats limiting new entrants has been challenged. DeepSeek, a Chinese developer of large language models (LLMs), released an innovative and lower cost model in January, highlighting the challenges US technology pioneers face in retaining their competitive edge and market share.

These emerging challenges represent a new phase for the AI story, and the outlook for US technology domination over time. As uncertainty surrounding geopolitics and growth has spiked, the winners of the past two years have borne the brunt of investors’ nerves.

There remains a high likelihood that dominant US companies at the forefront of semiconductor development and broad AI investment stand to prosper as AI adoption spreads. Yet investors will need to be more discerning about valuations, sentiment and competition than in the recent past. Increasingly, we expect active managers focused on long term growth opportunities from this theme to benefit, with shifting dispersion between winners and losers. The first phase of AI growth trend is likely over, and selectivity will be paramount to capture emerging opportunities, as innovations and developments continue at pace.

Investment Strategy: Leaning Defensive

The primary question posed is whether recent market declines may lead to a more prolonged period of disruption.Importantly, sustained periods of equity declines are rare outside of recessions or crises. As noted, the risks of such an economic backdrop has increased, but they are not overwhelming. We are not observing credit market stress, elevated corporate bankruptcies or widespread layoffs. Indeed, several indicators of US consumer health remain resilient.Furthermore, the global manufacturing sector has improved, with notable benefits flowing to European economies that have experienced such sluggish growth in recent years.

Our multi-asset strategy favours continued engagement with equity markets, focusing on fundamentals that will drive long term results over shorter-term swings in sentiment. Portfolios have tilted towards high quality components of the equity market for some time, with a notable bias towards healthcare and insurance. Having reduced smaller company investments earlier this year, our equity strategy has a defensive character, supporting overall results in recent weeks.Driven by our expectation for a continued moderation in growth and inflation, a preference for government bonds as opposed to lower quality credit has been beneficial.

Looking forward, we remain alert to the potential for elevated uncertainty and shifting geopolitics to drive volatile market conditions. We retain confidence in the defensive and broadly diversified portfolio balance of risk and return drivers, and are watching signals for adjustment closely. Our forthcoming April Investment Outlook will elaborate further on these themes, in addition to the implications for European economies and investment markets.

Chief Investment Officer Group 13 March 2025

i Source: Bloomberg, USD, Bloomberg Magnificent 7 Index. 13 March 2025ii Source: FactSet, S&P Global, February 2025

iii Source: Factset Earnings Insight, 7 March 2025

iv Source: President Trump’s victory speech, 6 November 2024

v Source: FactSet, February 2025

vi Source: President Trump’s interview with Fox News, 9 March 2025

Disclaimer: Stonehage Fleming Services This communication has been prepared for information only and is not intended for onward distribution.

Opinions expressed here are as of the date of publication and subject to change without notice. Stonehage Fleming Investment Management Ltd shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. All investments risk the loss of capital.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).